When you create an account with Whisky.Auction the correct VAT treatment will be determined based on your country and status (Private Customers, International Customers, VAT Registered Customers).

Here we break down what this means for you.

Private customers in the UK

If a lot is being sold by another private UK seller you will just pay VAT on commission. See our article on the Auctioneers' Margin Scheme for more details.

When a lot is sold by a VAT registered business or an international seller to a UK resident, it is subject to standard VAT, which will be added to the full price (hammer price + commission) at checkout.

International Customers

International buyers (with delivery addresses outside of the UK) are not subject to VAT, although local taxes may apply. International sellers will continue to pay VAT on services, including commission, listing and reserve fees and delivery.

Please note, if you choose to collect your order or have it delivered to a UK address you will be subject to VAT. See Private Customers in the UK above for full details.

UK Trade Customers

Non-VAT registered

UK based companies that are not VAT registered are subject to the same VAT rules as a private customer See above. See Private Customers in the UK above for full details.

VAT registered

VAT registered businesses are subject to standard VAT on all lots. We will automatically provide a VAT receipt for you at checkout.

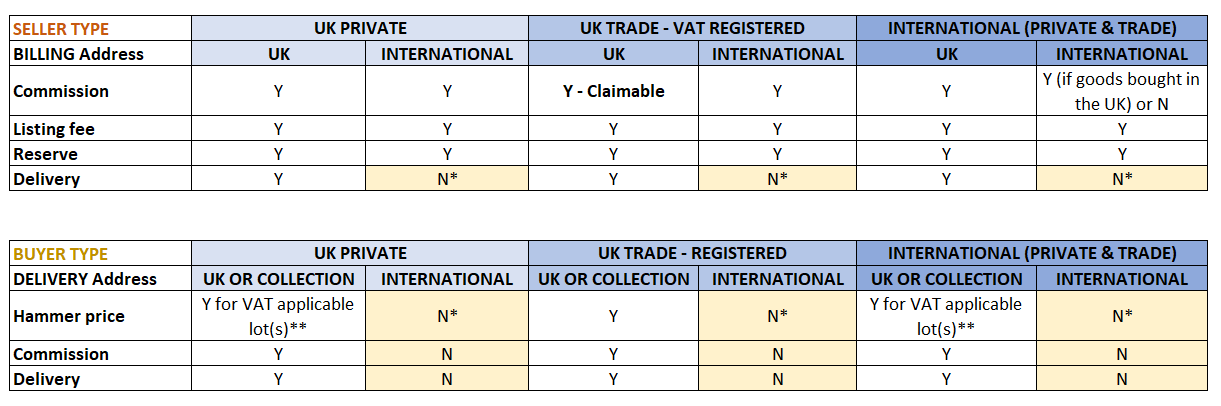

The below table provides a visual version of the information above.

*local charges may apply

** lots sold in the UK from international or trade sellers

Still have questions on VAT?

Contact us via email or give us a call.